Dubai – Masaader News

Q4 witnessed a total of eight IPOs in Q4 2017 in the Gulf Cooperation Council (GCC), representing a notable increase compared to the previous quarter (Q3 2017: 5), and raising a total proceeds of USD 2.5 billion, an increase of USD 2.3 billion compared to Q3 2017 (USD 234 million).

Compared to the same period last year, the number of IPOs and proceeds raised in Q4 2017 is considerably higher with USD 2.5 billion from a total of eight floats, compared to only USD 37 million raised from one IPO in Q4 2016.

Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) led the GCC IPO activity this quarter (Q4 2017) in terms of proceeds, with two major offerings, raising USD 2.2 billion (88% of total GCC proceeds).

Tadawul was the largest in terms of IPO volume, witnessing IPOs of three Real Estate Investment Trusts (“REITs”) (38% of total IPO volume in Q4), raising USD 209 million.

Whereas, the Muscat Securities Market (“MSM”) saw three IPOs, which raised total proceeds of US 82 million.

Year on year performance

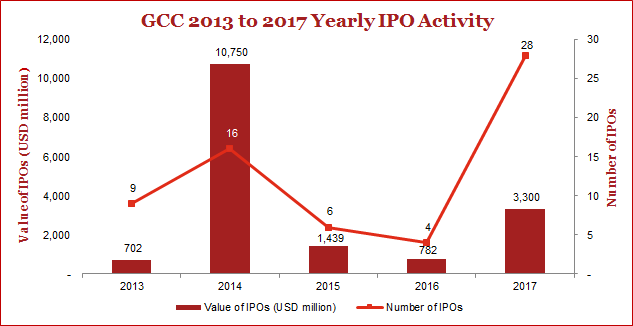

The total number of GCC IPOs increased significantly in 2017 to reach 28 offerings, compared to four in 2016. This was driven by increased listing activity on Tadawul’s NOMU parallel market, which welcomed nine IPOs (32% of 2017 GCC volume), together with the introduction of REIT listings which also saw nine IPOs across the GCC.

Furthermore, proceeds raised during 2017 were higher by USD 2.5 billion (322%) compared to 2016, mainly due to the USD 1.3 billion IPO proceeds raised by Emaar Development PJSC and USD 850 million IPO proceeds raised by ADNOC (together 66% of total GCC proceeds during 2017).

Steve Drake, Head of PwC’s Capital Markets and Accounting Advisory Services in the Middle East said: “The GCC IPO activity ended 2017 on a high, supported by government policies and improved market conditions. Furthermore, we are seeing renewed appetite for cross-border IPOs and an increase in confidence from institutional investors in GCC equity markets.”

Adding “ The outlook for 2018 looks positive, with a strong diversified IPO pipeline subject of course to volatility arising from geopolitical factors. The spotlight will remain on Aramco’s IPO, in 2018 which if it comes to market will be the largest global IPO ever”.

Global IPOs

Global IPO activity in Q4 recorded total proceeds of USD 63.5 billion from 370 IPOs. The quarter was 17% higher in terms of proceeds and 9% lower in terms of the number of IPOs, compared to Q4 2016. In 2017 as whole, the Global IPO activity was robust with total proceeds of USD 204.7 billion from 1,483 IPOs, outperforming the previous year in terms of number of IPOs and total proceeds by 47% and 44%, respectively.

The number of IPOs hit a post-financial crisis high, with global IPO activity benefitting from favourable conditions throughout the year, while volatility remained low, as jitters surrounding the French election and the Korean peninsula have failed to unnerve investors. Despite the expectation that monetary conditions will tighten in the US and Europe, the global IPO pipeline for 2018 looks promising.

The largest IPO for the year was Snap, a US based technology company which raised USD 3.9 billion on NYSE.

GCC bond and sukuk issuances

Q4 2017 was a strong quarter for debt issuers in the GCC, with the KSA and Abu Dhabi governments amongst key sovereigns, issuing international bonds worth USD 12.5 billion and USD 10 billion respectively.

Yearly performance

GCC fixed income transactions have surged in 2017, with sovereign issuers accounting for the lion’s share; followed by corporate debtors, amid strong interest from regional and international investors, cemented by a stable credit outlook.

On the sovereign front, the government of KSA raised a total of USD 21.5 billion, between sukuk issuance of USD 9 billion in Q2 2017, and bond issuance of USD 12.5 billion in Q4 2017. The government of Abu Dhabi was another leading issuer with USD 10 billion worth of bonds issued in Q4 2017.

On the corporate front, Dubai Aerospace Enterprise (DAE) Ltd (“DAE”) issued one of the largest bonds during the year, raising USD 2.3 billion; while the Islamic Development Bank (“IDB”) issued one of the largest sukuks during the year, raising USD 1.25 billion.

Steve Drake, Head of PwC’s Capital Markets and Accounting Advisory Services team in the Middle East said: “GCC sovereign and corporate debt issuers continued to remain very active during the year, as they have capitalized on strong debt markets globally at competitive rates, ahead of expected interest rate hikes. Moving forward, the US Federal Reserve’s hawkish monetary policy along with ECB plans to scale back quantitative easing may cause a ripple effect on borrowing costs for GCC debt issuances.”