Dubai- Massader News

Foreign investment in Egyptian debt hit a historic high, completely reversing outflows in 2020 spurred by the coronavirus pandemic, according to bloomberg.

Overseas holdings of the North African nation’s Treasury bills and bonds reached $28.5 billion at the end of February, according to Mohamed Hegazy, head of the Finance Ministry’s debt management unit.

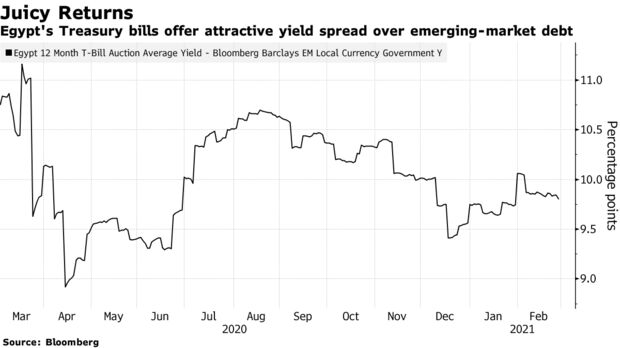

The appetite is being fueled by Egypt’s high real-interest rate, which is second only to Vietnam among more than 50 major economies tracked by Bloomberg, as well as returns of 1.7% since end-December. That compares with an average 2.6% decline across emerging markets, according to Bloomberg Barclays indexes.

Foreigners have pumped billions of dollars into Egypt’s debt market since authorities in late 2016 devalued the currency as part of a sweeping economic program backed by a $12 billion loan from the International Monetary Fund. Flows temporarily reversed when the pandemic hit, with around $17.5 billion exiting the country in spring 2020.

Egypt is drumming up yet more interest: it aims to have its local debt settled by Belgium-based Euroclear Bank SA from later this year, and says it’s met the requirements to list its notes on JPMorgan Chase & Co.’s Government Bond Index for emerging markets, which attracts investments from passive funds that track the gauge.

The most populous Arab nation is also making progress with plans to reduce borrowing costs by extending the average maturity of its debt. The proportion of bonds’ net issuance increased to 110% of domestic offerings by the end of February, exceeding the target of 80% that the country wanted to reach by June, Hegazy said in an interview.

“New debt instruments issued in 2021 could entice more investors and cut borrowing costs,” Hegazy said.